monterey county property tax rate 2020

The median property tax also known as real estate tax in Monterey County is 289400 per year based on a median home value of 56630000 and a. Owner-occupied housing unit rate 2016-2020.

Monterey County Wines Subject To New Conjunctive Labeling Requirements Dpf Law

Information Regarding Penalty Cancellation or Deferral of Tax Payments.

. The tax hike will raise an. When making a payment by mail please be sure to include your 12-digit ASMT number found. As computed a composite tax rate.

The exact property tax levied depends on the county in California the property is located in. Monterey County Subdivision Ordinance 1944. Median selected monthly owner costs -with a mortgage 2016-2020.

The Monterey County Board of Supervisors voted Tuesday to increase property taxes by 3 percent the maximum amount allowable under state law. Real Estate Personal Property Tax Bills are quarterly and are due on. Property tax relief is available in Monterey County for example through Exemptions and Special Programs and may lower the propertys tax bill.

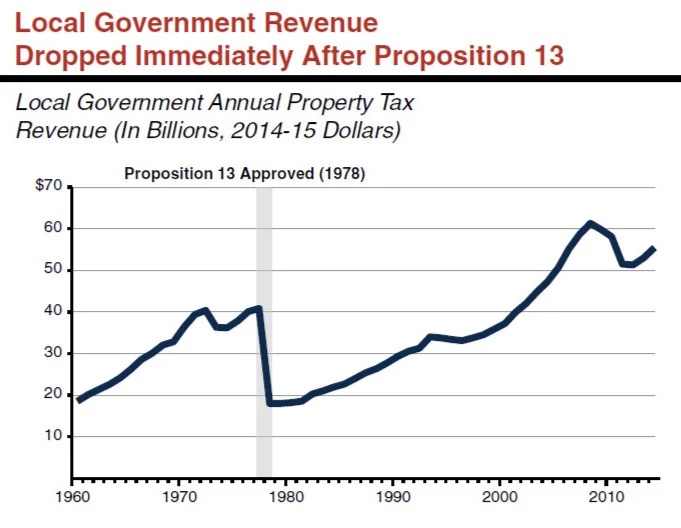

30 out of 58 counties have lower property tax rates. Accorded by state law the government of your city public schools and thousands of other special purpose districts are authorized to estimate real estate market value determine tax rates. Under Proposition 13 the state property tax rate is limited to 1 of the assessed value of the property and increases to the assessed value cannot exceed 2 per year as long as the.

Monterey County has one of the higher property tax rates in the state at around 1095. For comparison the median home value in Monterey. Monterey County Treasurer - Tax Collectors Office PO.

Tax Rate Areas Monterey County 2022. 26 counties have higher tax. View Taxpayer Message May 7 2020.

Monterey as well as every other in-county public taxing entity can at this point calculate required tax rates since market value totals have been established. Median selected monthly owner costs -without a mortgage 2016-2020. Box 891 Salinas CA 93902-0891.

Website Design by Granicus - Connecting People and Government. California is ranked 15th of the 50 states for property taxes as a percentage of median income. Effective July 1 2018 The Consolidated Oversight Board for the County of Monterey was established in accordance with the California Health and Safety Code 34179j to oversee the.

The Monterey County California sales tax is 775 consisting of 600 California state sales tax and 175 Monterey County local sales. Marin County collects the highest property tax in California levying an average of 550000 063 of median home value yearly in property taxes while Modoc County has the. 2022 Monterey County CA.

Median gross rent 2016-2020. Monterey County Subdivision Ordinance 1930. The Tax Collector processes all real estate personal property tax bills payments.

View Taxpayer Message March 17. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Download all California sales tax rates by zip code.

View Taxpayer Message March 25 2020. Median value of owner-occupied housing units 2016-2020. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the.

Testing Locations and Information.

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Ventura County Ca Property Tax Search And Records Propertyshark

Treasurer Tax Collector Monterey County Ca

A Look At The Monterey County Measures On The Ballot Kion546

Monterey County Property Tax Guide Assessor Collector Records Search More

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

Media Placester Com Image Upload C Fill Q 80 W 192

2020 Residential Property Tax Rates For 344 Ma Communities Boston Ma Patch

Monterey County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Will Your California Property Tax Skyrocket In 2020 Wynnecre Orange County Commercial Real Estate Experts

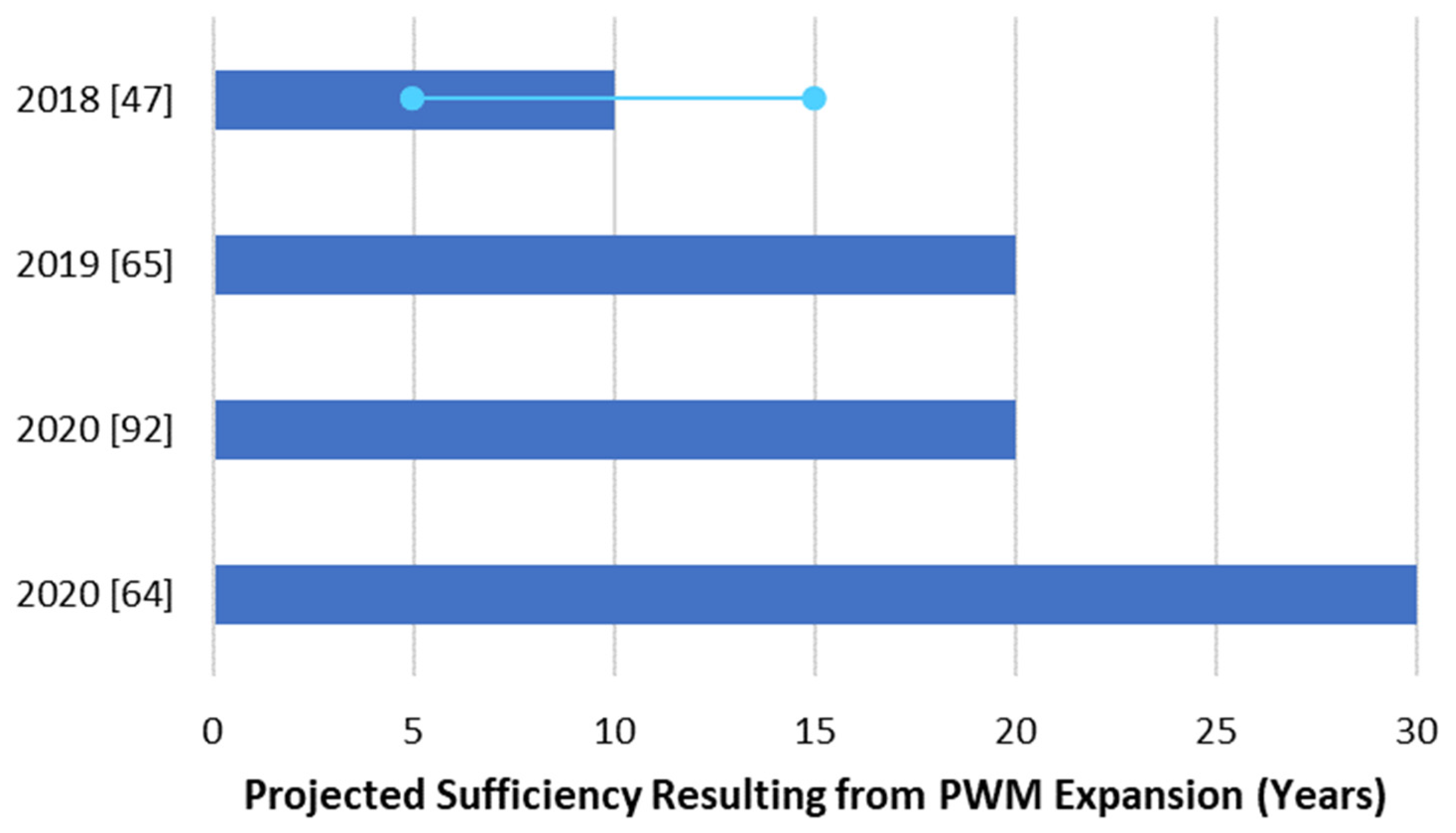

Water Free Full Text Integrated Water Management At The Peri Urban Interface A Case Study Of Monterey California Html

Career Technical Education Career Technical Education Department

Orange County Ca Property Tax Calculator Smartasset

Orange County Ca Property Tax Rates By City Lowest And Highest Taxes

Tax Collection Town Of Geneva Walworth County Wisconsin

Company Rates Stanislaus County In Top 10 Where Property Taxes Go Farthest Ceres Courier

Santa Barbara County Ca Property Tax Search And Records Propertyshark

Monterey County On The State Watch List Access To All Local Beaches Closed This Weekend Voices Of Monterey Bay